10 Hardware Companies with a Recurring Revenue Business Model

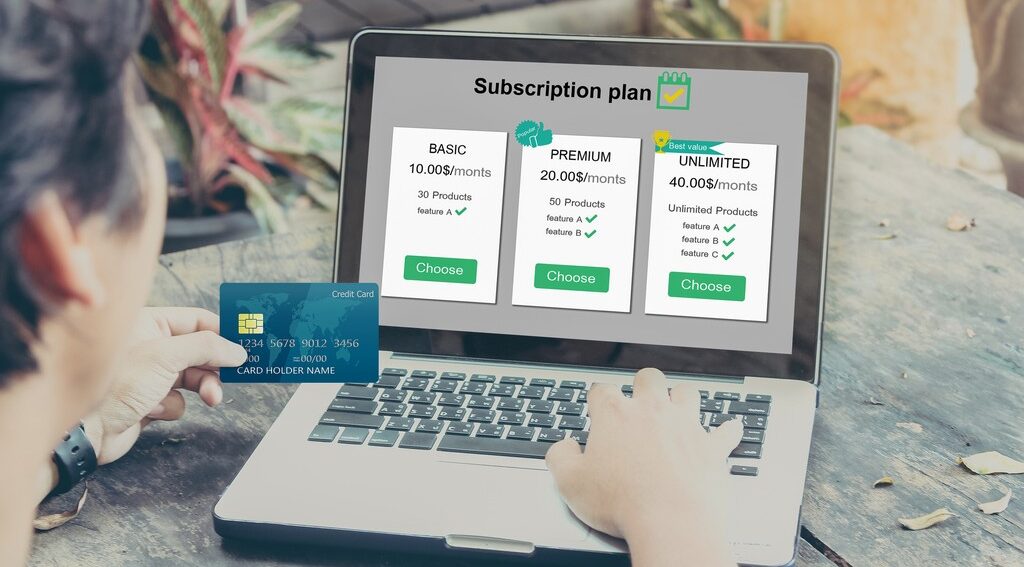

If at all possible, you need to find a way to incorporate at least some recurring revenue into your hardware business model.

Recurring revenue adds stability to your startup, improves your cash flow, fosters long-term customer relationships, makes your company more desirable to investors, and even increases the value of your company.

Ultimately, recurring revenue makes your startup more scalable and your life less stressful. But, finding a way to add recurring revenue to a hardware-based business isn’t always obvious.

To give you some ideas, this article will share a few other hardware companies that incorporate recurring revenue into their business model in a variety of ways.

Although you may have heard of one or two of these companies, most of these young companies are relatively unknown.

Latch

Boasting recent annual revenue of $140M, this IoT company produces a world class keyless entry and management system for large buildings.

In the U.S., more than 1 in 10 new apartment buildings are integrating Latch products into their building plans. Given these stats, it seems very likely that this company will continue to grow at a vigorous rate for a long time to come.

In addition to profiting generously from the initial sale of the hardware, the company further benefits from long term recurring payments, which are part of the customer’s commitment from day one.

The technology relies on LatchOS, a proprietary software, for normal operation of the entry locks.

The program, accessed by the customer via a SaaS subscription arrangement, allows the building manager to open any lock in a controlled building from their smartphone.

It’s an ingenious business model because the customer agrees to full immersion into the company’s subscription terms from the beginning.

It’s like selling a customer the lock and then renting the key to them afterward, and all with their full, up-front approval.

Tive

Specializing in the design and production of smart GPS technology, this company has carved a big niche for itself in the shipping and transport industry.

Tive manufactures load monitoring GPS devices which have numerous sensing capabilities, such as temperature and shock data. Picture the GPS device attached to a shipping container, allowing the owner to obtain real time data about their cargo.

Partnering with a long and distinguished list of logistics giants as well as directly with well-known manufacturers, the company receives significant revenue from the sale of their hardware – the GPS units.

Additionally, the sale of the device becomes an agreement for recurring revenue in the form of the shipment monitoring service that Tive provides, once the load is in transit.

Since the devices have a very limited life span, they are deemed disposable and the logistics company finds itself in need of a steady supply of both the hardware and the continued monitoring service provided by Tive.

StrongArm Technologies

Worker safety has never been this high tech, except for astronauts perhaps.

This workplace safety startup produces sensor devices which measure or predict a gallery of human conditions, ranging from physical to psychological.

Properly fitted onto a worker, these sensors allow analysts at StrongArm to provide insights into the state and safety of a given user’s body.

Companies in turn can offer advice to workers in distress, or even resort to direct intervention if circumstances warrant such measures.

StrongArm pulled in $50M in series B funding very recently.

Zoomo

Specializing in the production, rental and servicing of electric bicycles, Zoomo could be poised to take a substantial urban market share from auto manufacturers.

EVs have taken the transportation industry somewhat by storm in recent years, by offering a greener and cheaper alternative to personal mobility and light cargo delivery.

Zoomo plans to lead the transition of urban transport from cars and trucks to electric bikes, worldwide.

Recurring revenue in this business model is secured by a steady flow of rental agreements from a continually expanding, repeat customer base.

The company offers 3 tiers of rental agreements, ranging from $29 – $49/week, each targeted to meet the needs of commuters and professional couriers. Free servicing and theft coverage makes the rental agreement more appealing than owning.

While the option of purchasing the vehicles is available, the emphasis of the business is the rental aspect.

It’s easy to imagine commuters becoming ever increasingly dependent on electric bikes, considering the cost savings over using a car. In this way, it would seem that Zoomo has the right product and business model, at the right time.

Peloton

By now you’ve probably seen Peloton’s ads or product placement in popular TV shows, or you might even own their exercise equipment.

This wildly popular fitness concept employs a variety of incredibly lucrative base scenarios to accomplish their business objectives.

Peloton produces stationary bikes and treadmills which are set up with a viewing screen and sound system. The hardware, the bikes, sell for between $1,500 – $2,500.

The equipment also connects to the internet, and through a subscription the user can watch exclusive streaming workout videos or engage in interactive exercise games.

If there’s any doubt as to the appeal of their streaming media service, there need not be. Peleton’s approach is in such high demand that they have an entire population of users who don’t even own the company’s equipment.

These fitness buffs simply pay a healthy fee every month to watch the videos and workout along with the Peloton community.

This business model is so successful that the company has needed to defend itself in court against design piracy.

In an all-out legal battle, it was proven that Flywheel Sports had produced exercise equipment using Peleton’s designs, subsequently resulting in Flywheel Sports being edged into bankruptcy.

One World Rental Global IT

Utilizing the Hardware-as-a-Service (HaaS) business model, this company has become the leading UK provider of technology solutions for corporate events.

Although they manufacture a limited number of their own hardware designs, the company’s main focus is to rent out equipment from other trusted brands.

Laptop and tablet rentals, along with nearly any other technology solution one can think of, has made this company a world leader in high tech event facilitation.

Some of the largest brands in business today have been partnering with One World as their chosen provider of technology for corporate events. This saves the customer valuable time and human resources in addition to reducing equipment ownership costs.

One World has the ability to provide the most updated line of equipment available on the market, sweetening the deal that much further for their big name corporate clients.

Tesseract Health

Detection, monitoring and treatment of disease is the primary function of this holistic health-tech startup.

The company produces a device which scans a patient’s eyes, and electronically differentiates between good or poor health throughout various regions of their body.

If problems are detected, the device can address those issues in a non-invasive way by applying treatment in the same ocular fashion, electronically through the scanning device.

Tesseract Health is poised to hold status as both physician and cure simultaneously on an ongoing basis, thus providing a reliable source of recurring revenue.

Lightmatter

In the global race to jump ahead in computer processing technology, this company may prove to be a real breakthrough.

Lightmatter has engineered a brand-new kind of CPU, tapping into the largely unharnessed field of photonics to achieve their goals.

This technology relies on the analysis and processing of light photons, as opposed to the traditional electronic method, which relies on electron analysis and control.

It’s expected that the world will flock to receive this technology, because it can drive AI applications with ease, as well as most any other type of heavy processing demand.

Recurring revenue in this case is very likely to be assured in many ways, one of these being patent technology regeneration. Licensing your new technology can be a great way to add recurring revenue to your business model.

Karma

The world depends on the internet, so why not capitalize on the need? Karma is doing just that, by offering users a go-anywhere internet connection.

The hardware for these portable hotspots is reasonably priced at $59.99, while still costing enough to be profitable for the company.

After purchasing the device, the user can choose from a selection of options for their internet coverage subscription, with data usage plans from $10 – $70 per month.

Tendeg

Recurring revenue can take many forms and having near-exclusivity in a company’s chosen field means your customers don’t have many options to choose from.

One case in point is Tendeg, an aerospace technologies company that produces high-range antennas for satellites.

Deploying equipment the size of antennas is tricky, especially when it needs to happen automatically and in a very remote setting.

In outer space, a failed antenna deployment would likely mean an entirely wasted mission, including launch costs.

By maintaining a reputation for reliability, Tendeg has virtually assured itself a place among the stars.

Conclusion

There are many different avenues for generating recurring revenue long after the initial point of sale. Recurring revenue models benefit both the company and the customer by fostering a deeper long-term relationship.

The hardware startup today that ignores the potential for recurring revenue will be leaving money on the table, which more savvy founders would surely claim.

If it is at all possible, figure out a way to add recurring revenue to your business model from the very beginning.

Did you know that even Taco Bell recently added recurring revenue by offering a $10 monthly subscription where you get one taco per day. If they can find a way to add recurring revenue, then so can you.

Although not specifically for hardware companies, I highly recommend the book

The Automatic Customer by John Warrillow where he reviews numerous examples of companies successfully adding recurring revenue.

Other content you may like:

- Business Models and Recurring Revenue for Hardware Startups

- Lesson 2: The Strategic Way to Develop and Sell Your New Electronic Hardware Product

- The Key Elements of a Business Plan for Hardware Startups

- 10 Successful Hardware Companies You Probably Never Heard About

- How to Get Investors and Co-Founders for Your Hardware Startup

Enjoyed the whole article, then got to the end… Taco Bell? TACO BELL??? That will silence the critics.

A recent hardware startup with an interesting recurring revenue model is Wiliot.com . They harvest ambient RF to power smart tags. Not edible though, so Taco Bell will have to look elsewhere…

Thanks Dave for sharing Wiliot.com.

Yeah, Taco Bell is proof that everyone sees the benefit of recurring revenue. Burger King also recently started a subscription service where you get unlimited coffee every day for only $5/month. But, they are not making the profit on that $5 monthly payment though, and instead this acts to bring customers back on a regular basis knowing they will buy other items to go with their free coffee.

Now you’ve done it, John. I’m getting ads for Panera’s Unlimited Club; unlimited coffee, lemonade, etc.